As we dive deeper into the “digital age” many more of us are turning to online resources to file our tax returns. And why not? It saves time and money, makes the task of gathering information about our expenses, assets, income and relevant tax codes less daunting and allows us to receive tax refunds more quickly. According to the IRS, 90% of online filers receive their refunds within three weeks or less, as opposed to paper filers whose returns often take much longer to process (not to mention that there’s no sure-fire way to know whether your return has even been received).

Even the Internal Revenue Service (IRS) advocates for electronically filed tax returns over paper, and has reported a 7.5% increase in self-prepared taxes in 2014, compared to 2013.

As we prepare for tax season, however, it’s important to stay informed about scams that target e-filers. The IRS is warning about new tax phishing scams. Phishing can be described as “the fraudulent practice of sending emails purporting to be from reputable companies in order to induce individuals to reveal personal information, such as passwords and credit card numbers.” These malicious messages vary, but they are all after one common goal: monetary profit.

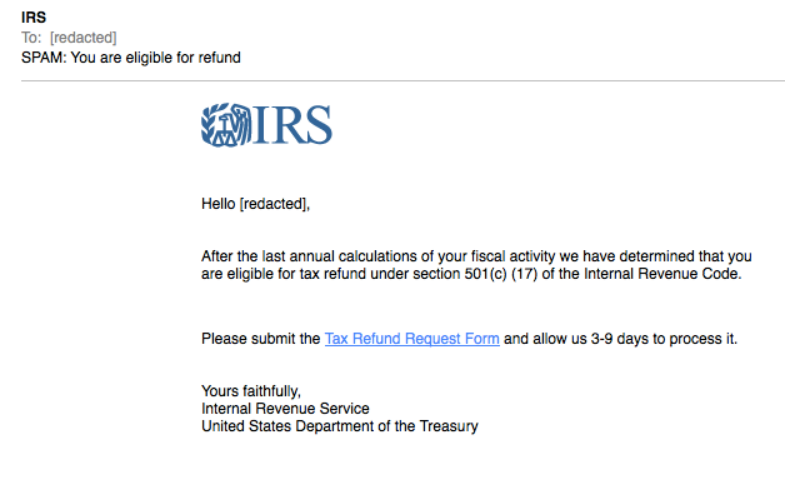

Individuals sending e-mails like the one above aim to collect as much personal information (i.e. your name and Social Security number) as possible, in order to file a fake tax return and collect a refund. The scammers disguise their identity, impersonating IRS officials, TurboTax, and other companies/organizations alike, claiming they need your personal information so you may successfully file taxes online or receive a tax return.

Most of these e-mails lead the message recipients to select a link where they complete a form about themselves, while in other situations, a link can download malware (malicious software) onto a computer, compromising the stored information within the device.

The IRS advises taxpayers to ignore these fraudulent e-mails, urging users to avoid clicking on these suspicious links. The IRS, by the way, will never contact you via e-mail to ask for your personal or financial details. If you’re suspicious about a message you’ve received, send it to phishing@irs.gov.

Filing your taxes online provides tremendous cost savings and other benefits, but it’s always prudent to be aware of activities that appear suspicious. QUESTION the things you see online, CHECK for validity, and ASK your friends or neighbors.

Resources to help keep you safe:

To obtain more information on other tax-related scams, you can learn more here: http://tinyurl.com/hvvny4g

What if you have already fallen victim of your tax refunds being stolen? Find out ways you can recover: http://tinyurl.com/hotl4zz

The Piers Project is funded by a gift from the family estate of Ellie Piers to benefit the Front Porch Center for Innovation and Wellbeing’s (CIW’s) ongoing mission of using technology to enhance wellbeing among older adults. Piers lived at Carlsbad By The Sea, a Front Porch retirement community in Carlsbad, CA. Her contribution allows the CIW to address cyber security through education, training, and the use of technologies that promote Internet safety, especially in the greater San Diego area.